General Ledger Intercompany FAQ

Question: If I have multiple corporate entities in my general ledger structure, how do I set up the general ledger intercompany relationships?

Answer: There are different ways to set this up, depending on the degree of complexity you require. To set up the intercompany relationships, perform the following steps:

-

In Ledger Maintenance, define one element as a company element. Select the Define Company check box for the general ledger element that will represent the corporate entity.

Note By selecting this check box, all general ledger entries must balance for accounts that share the same value in this element.

Example The first element is used to define the company, and two element values are set up, 01 and 02. For any general ledger entry, the debits must equal the credits for accounts that have a first element value of 01 (same with 02).

-

In General Ledger Category Maintenance, set up a category with the Intercompany check box selected. This setting is set up to filter the list of accounts that appear in Intercompany Account Maintenance.

-

In Account Element Maintenance, set up an element value for each company. If there are four companies, set up four element values representing these four companies.

-

In Account Maintenance, set up one intercompany general ledger account for every company. Make sure to use a general ledger category for which the Intercompany check box is selected. These accounts are required before performing any intercompany transactions.

-

In Intercompany Account Maintenance, set up a default intercompany account for each company. In New mode, select a company, the intercompany general ledger account to be used and select the Default check box. If you only need simple intercompany relationships, you can stop at this point, and can skip step 6.

-

In Intercompany Account Maintenance, set up additional intercompany accounts for each company-to-company relationship. If you want more complex intercompany reporting, set up each company-to-company relationship.

Question: If I enter an accounts payable voucher that has two or more expense accounts for different companies, how does the software know which general ledger intercompany accounts to use?

Answer: When you enter an accounts payable voucher, you always have to specify the accounts payable account. The company associated with the accounts payable account is compared to each company associated with each expense account. If the accounts payable account company has an intercompany account set up with the expense account company, then those intercompany accounts are used. Otherwise, the default intercompany accounts for each company are used.

Example Company 1 is the accounts payable account, and Company 2 and Company 3 are the expense accounts during a voucher entry. Company 1 and Company 2 have an intercompany account relationship set up between them (so those intercompany accounts are used). Company 1 and Company 3 do not have an intercompany account relationship set up between them (so their default intercompany accounts are used).

Question: If I enter a manual journal entry in Journal Entry (or import a journal entry in Journal Entry Import) that has line items for multiple companies, how are general ledger intercompany accounts determined?

Answer: When entering a manual general ledger journal entry, the account for the first entered credit or debit is used to determine the first company for the intercompany account relationship. If no specific intercompany accounts are set up to balance the entry by company, then only the default intercompany accounts for each company are used to balance the journal entry.

Note If you click the Company Analysis button in Journal Entry, you can see if accounts for any company are out of balance, and if so, see the amount that is out of balance.

Question: How can two accounts (a Due To account and a Due From account) be set up for each company's intercompany dealings?

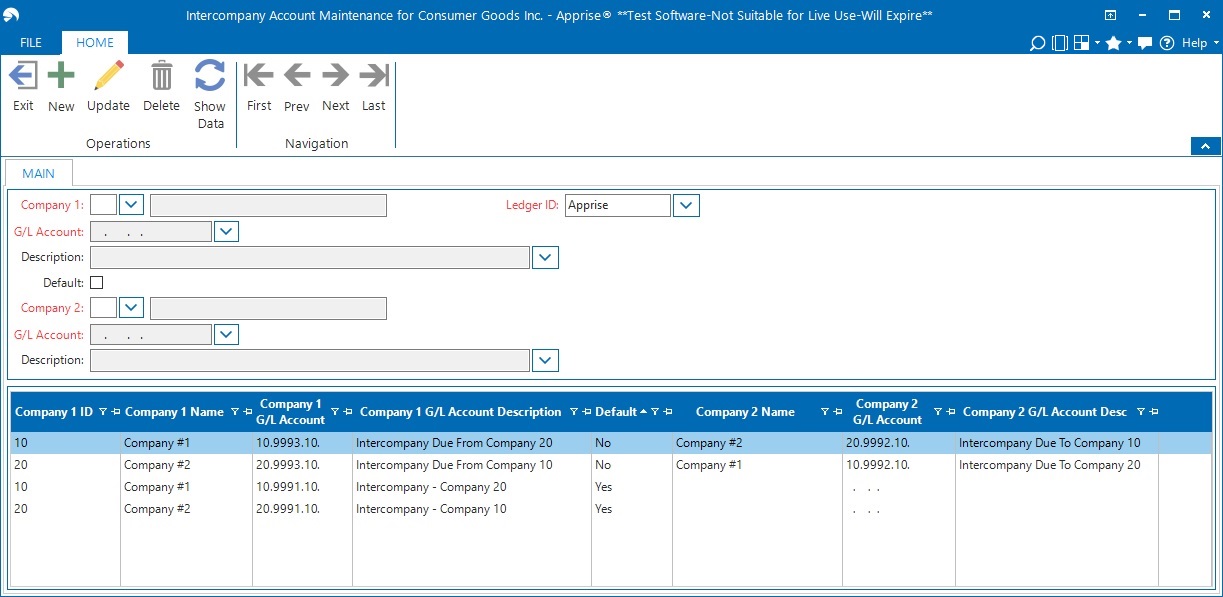

Answer: This can be accomplished by setting up two records in Intercompany Account Maintenance, per the following example:

For sales or voucher transactions where the accounts receivable or accounts payable company is 10, the first record’s pairing is used (10.9993.10 and 20.9992.10) to balance the intercompany accounts.

For sales or voucher transactions where the accounts receivable or accounts payable company is 20, the second record’s pairing is used (20.9993.10 and 10.9992.10) to balance the intercompany accounts.

The Company 1 field controls the selection of the intercompany pairing to use based on the company code of the accounts receivable or accounts payable account. If the software cannot find a pairing, it uses the default intercompany account.